39 what are coupon payments

Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms... Coupon Payment | Definition, Formula, Calculator & Example A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments.

What is Coupon payment | Capital.com It's the annual interest payment made by the issuer of a bond to the bondholder until it reaches maturity. The coupon payment - or simply coupon is expressed as a percentage of the bond's value at the time it was issued. Where have you heard about coupon payment? The term coupon comes from once popular bearer bond certificates.

What are coupon payments

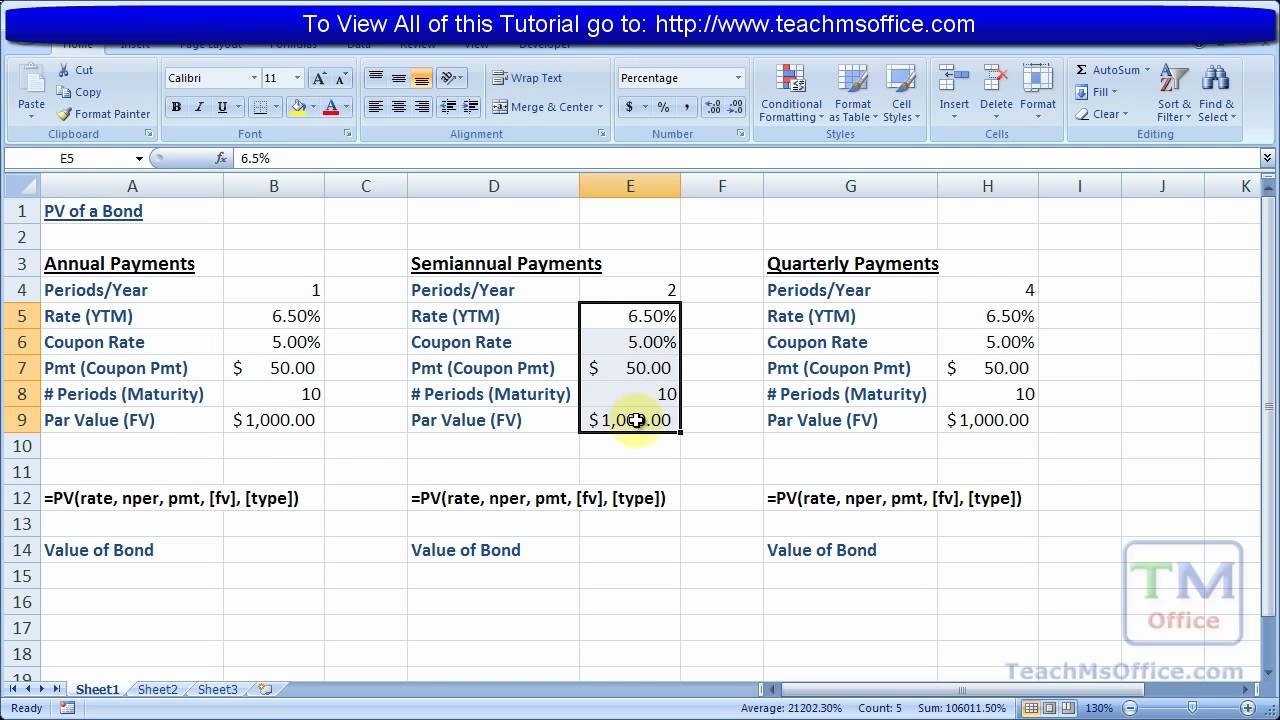

How to Calculate a Coupon Payment: 7 Steps (with Pictures) Since bondholders generally receive their coupon payments semiannually, you just divide the annual coupon payment by two to receive the actual coupon payment. For example, if the annual coupon payment is $80, then the actual coupon payment is $80/2 or $40. Tips The calculations above will work equally well when expressed in other currencies. What Are Coupon Payments? - ClydeBank Media Coupon payment is the periodic payment of interest by a bond issuer to a bondholder. Coupon payment is not to be confused with stock dividend payment—the two are distinct in a few ways. When an investor or trader purchases shares of stock in a company, they are purchasing the rights to a portion of that company's profits. Coupon Payment Calculator - Definition | Steps by solution 🥇 Coupon payment is a feature of fixed income securities, such as bonds and notes. It describes the regular payments of interest to holders at intervals agreed upon by the issuer and investor when the security was issued. The frequency of payments may vary from semiannual (twice per year) to annual or more frequent. Deal Scraps

What are coupon payments. Coupon Payment | Investor.gov Coupon Payment The dollar amount of interest paid to an investor. The amount is calculated by multiplying the interest of the bond by its face value. Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity... Coupon Rate Formula | Step by Step Calculation (with Examples) Annual Coupon Payment Annual coupon payment = 4 * Quarterly coupon payment = 4 * $25 = $100 Therefore, the coupon rate of the bond can be calculated using the above formula as, Coupon Rate of the Bond will be - Therefore, Dave is correct. What is a Coupon Payment? - Definition | Meaning | Example What is the definition of coupon payment? Coupon payments are vital incentives to investors who are attracted to lower risk investments. These payments get their name from previous generations of bonds that had a physical, tear off coupon that investors had to physically hand in to the issuer as evidence that they owned the bond.

How to Calculate the Price of Coupon Bond? - WallStreetMojo The purchaser of a bond receives these coupon payments during the period between the issuance of the bond and the maturity of the bond. In the bond market, bonds with higher coupon rates are considered to be more attractive for investors because they offer higher yields. UBS declares coupon payments on 5 ETRACS Exchange Traded Notes CEFD and MVRL pay a variable monthly coupon linked to 1.5 times the cash distributions, if any, on the respective underlying index constituents, less withholding taxes, if any. Credit Suisse Announces Coupon Payments and Expected Coupon Payments on ... Coupon payments for the ETNs (if any) are variable and do not represent fixed, periodic interest payments. The Expected Coupon Amount for any ETN may vary significantly from coupon period to ... Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.

Coupon Payment Definition | Law Insider Coupon Payment means the payment of 0.25% per annum of the Deposit Amount (or $0.25 per Deposit Note) to be made to Holders on each Coupon Payment Date; Sample 1 Sample 2 Sample 3 Based on 14 documents Coupon Payment means with respect to a Coupon Payment Date the aggregate Coupon Amounts for the Coupon Period ending on such Coupon Payment Date. Coupon payments financial definition of Coupon payments Coupon payments are expressed as a percentage of the face value ( par) of a bond. For example, if one holds a bond worth $100,000 at 5% interest, the bondholder will receive $5,000 in coupon payments per year (or, more strictly, $2,500 every six months) until the bond matures or he/she sells the bond. How to Calculate a Coupon Payment | Sapling Twice-yearly equal coupon payments. If your security's par value is $1,000, and you receive two coupon payments of $25 each, your annual payment is $50 ($25 x 2 payments each year). Your coupon rate is 5 percent: $50 (total annual coupon payment) divided by $1,000 (par value) x 100 percent. Unequal periodic payments. Credit Suisse Announces Coupon Payments and Expected Coupon Payments on ... Coupon payments on the ETNs will vary and could be zero. There is no actual portfolio of assets in which any investor in the ETNs has any ownership or other interest. Investors in the ETNs do not ...

Loan Payment Coupon Book Alternatives - The Balance Make sure the following items are included in your coupon: Your name and address. Your contact information (especially a phone number to call if there are any questions about your payment) Your account number with the lender. Your payment due date. The amount of your payment. Any other information about your loan (to help your lender find your ...

What Is a Bond Coupon? - The Balance The interest payment is called a coupon payment. "Coupon clipping" means collecting the interest payment from a bond. The interest payments will stay the same for bonds with a fixed coupon rate. Changes in the market won't affect them. Interest payments are periodically adjusted to align with market rates if a bond has a floating coupon rate. 2

Coupon Bond Formula | Examples with Excel Template Step 2: Next, figure out the rate of annual coupon and based on that calculate the periodic coupon payment of the bond. The coupon payment is the product of the coupon rate and the par value of the bond. It also does not change over the course of the bond tenure. The annual coupon payment is denoted by C and mathematically represented as shown ...

Russia Bans Coupon Payment to Foreigners on $29 Billion in Bonds The Russian central bank has banned coupon payments to foreign owners of ruble bonds known as OFZs in what it called a temporary step to shore up markets in the wake of international sanctions.

What Is a Coupon Payment? - Smart Capital Mind A coupon payment is a payment made to the holder of a bond for the interest that bond accrues while it is maturing. This is typically made as a semi-annual payment, so only half of the interest owed on the bond is paid at a time.

Credit Suisse Announces Coupon Payments and Expected Coupon Payments on ... Coupon payments for the ETNs (if any) are variable and do not represent fixed, periodic interest payments. The Expected Coupon Amount for any ETN may vary significantly from coupon period to coupon...

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total ...

Gazprom Bondholders Face Dollar, Franc Coupon Payment Delays 45.80. USD. -1.07 -2.28%. The holders of two series of Gazprom PJSC notes face delays with coupon payments as Citigroup Inc., the securities' paying agent, checks the transactions are compliant ...

How Are Bond Prices Affected by Coupon Payment Dates? You are buying the bond on the 122nd day of a payment period that has 184 days. The seller is therefore entitled to 121/184 of the Feb. 15, 2000, coupon payment. A quick calculation shows that ...

Coupon Rate: Formula and Bond Nominal Yield Calculator Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000. Coupon Rate = 6%. Annual Coupon = $100,000 x 6% = $6,000. Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k ...

Coupon Payment Calculator - Definition | Steps by solution 🥇 Coupon payment is a feature of fixed income securities, such as bonds and notes. It describes the regular payments of interest to holders at intervals agreed upon by the issuer and investor when the security was issued. The frequency of payments may vary from semiannual (twice per year) to annual or more frequent. Deal Scraps

What Are Coupon Payments? - ClydeBank Media Coupon payment is the periodic payment of interest by a bond issuer to a bondholder. Coupon payment is not to be confused with stock dividend payment—the two are distinct in a few ways. When an investor or trader purchases shares of stock in a company, they are purchasing the rights to a portion of that company's profits.

How to Calculate a Coupon Payment: 7 Steps (with Pictures) Since bondholders generally receive their coupon payments semiannually, you just divide the annual coupon payment by two to receive the actual coupon payment. For example, if the annual coupon payment is $80, then the actual coupon payment is $80/2 or $40. Tips The calculations above will work equally well when expressed in other currencies.

Post a Comment for "39 what are coupon payments"