44 a 10 year bond with a 9 annual coupon

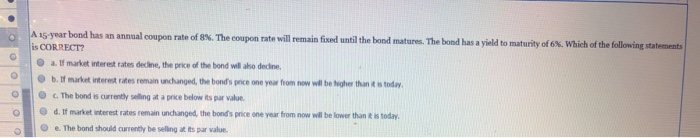

Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment. Answered: A 10-year bond with a 9% annual coupon… | bartleby Transcribed Image Text: A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? * If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. The bond is selling below its par value. The bond's current yield is greater than 9%.

OneClass: A 10-year corporate bond has an annual coupon of 9%. The bon Get the detailed answer: A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following stateme

A 10 year bond with a 9 annual coupon

› markets › rates-bondsUnited States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month Question 12 a 10 year bond with a 9 annual coupon has Question 12 A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? Selected Answer: If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. › finance › bond-priceBond Price Calculator | Formula | Chart Jun 20, 2022 · coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

A 10 year bond with a 9 annual coupon. › zero-coupon-bondZero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. A 10-year bond with a 9% annual coupon has a yield to maturity… I have a question: A 20-year, $1,000 par value bond has a 9% annual coupon. The bond currently sells for $925. If the yield to maturity remains at its current rate, what will the price be 5 years from … read more EOF A 10-year bond with a 9% annual coupon has a yield to maturity of 8% ... answered A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. The bond is selling below its par value. b. The bond is selling at a discount. c. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. d.

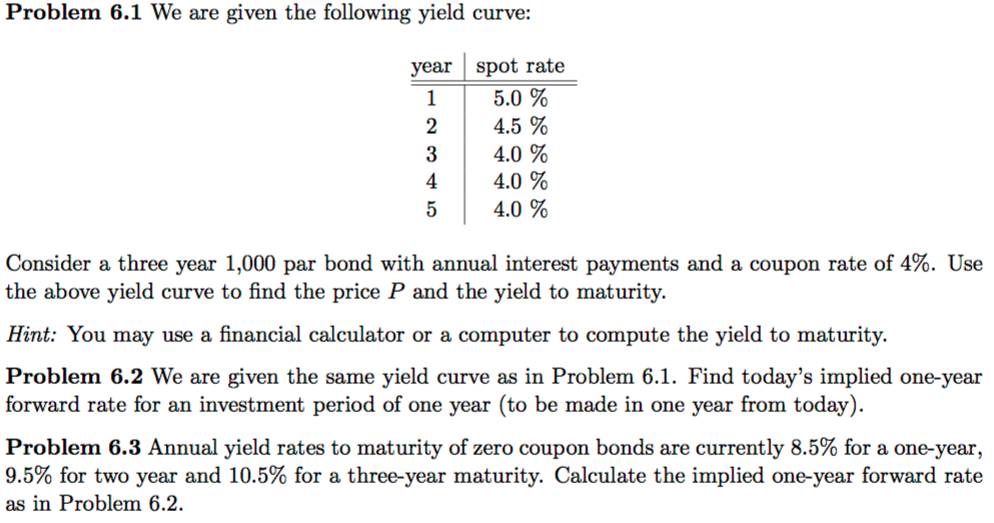

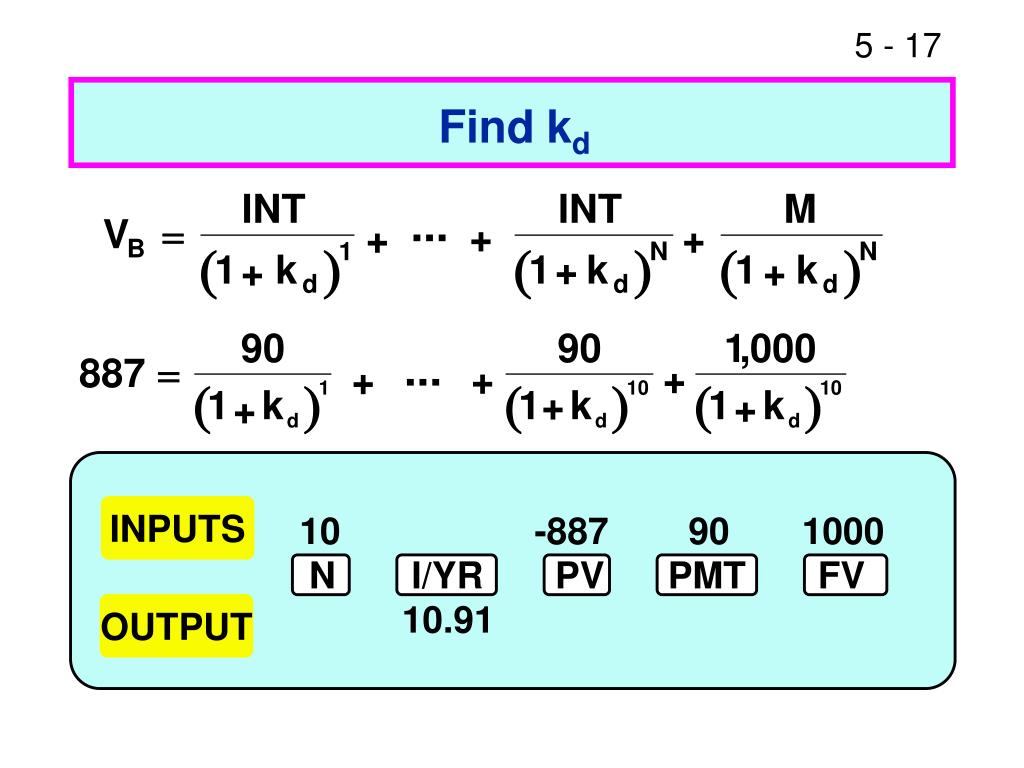

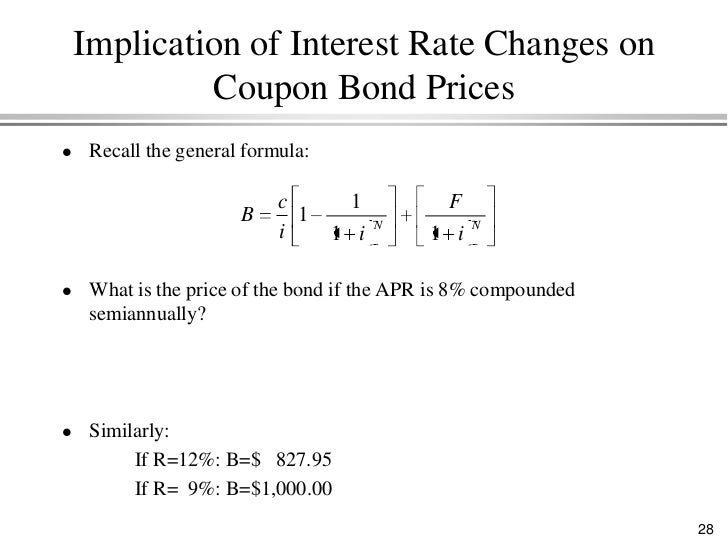

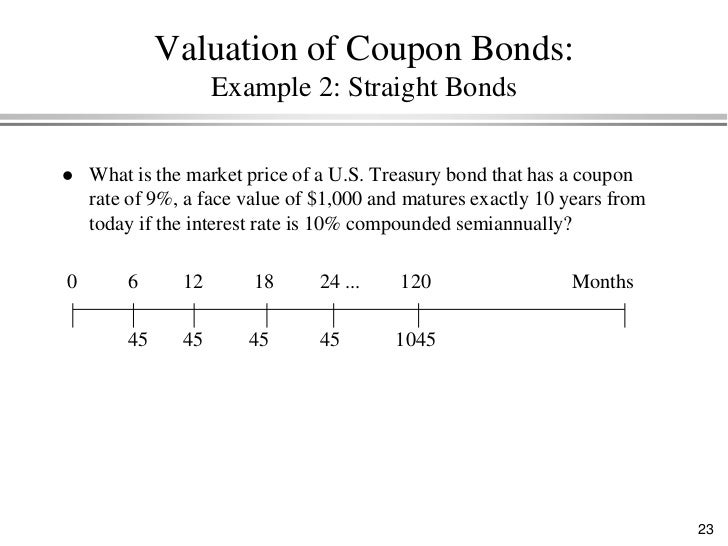

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon ... brainly.com › question › 27931387What is the yield to maturity for a 3 year bond with a 10% ... Jun 20, 2022 · The yield of maturity will be 10% itself , Option C is the right answer. The missing option are. What is the yield to maturity for a 3 year bond with a 10% annual coupon if the bond is trading at par? A) 11.00%. B) 9.00%. C) 10.00%. D) 9.75%. What is the meaning of Trading at Par ? At par means the bond or stock is trading at its face value , FINN 3226 CH. 4 Flashcards | Quizlet A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. › bonds-payable › explanationCalculating the Present Value of a 9% Bond in an 8% Market Since n = 10 semiannual periods, you need to go to the column which is headed with the market interest rate per semiannual period. If the market interest rate is 8% per year, you would go to the column with the heading of 4% (8% annual rate divided by 2 six-month periods). Go down the 4% column until you reach the row where n = 10.

Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg Question: A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. the bond is selling below its par value b. the bond is selling at a discount c. the bond will earn a rate of return greater than 8% d. the bond is selling at a premium to par value This problem has been solved! chapter5practicetest.docx - A 10-year bond with a 9% annual... chapter5practicetest.docx - A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? Select chapter5practicetest.docx - A 10-year bond with a 9% annual... School Texas State University Course Title FIN 3313 Uploaded By tynupe Pages 6 Ratings 71% (7) Solved A 10-year corporate bond has an annual coupon of 9%. - Chegg A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is CORRECT?a. The bond's expected capital gains yield is zero.b. The bond's yield to maturity is above 9%c. The bond's current yield is above 9%d. A 10-year $1,000 par value bond has a 9% semiannual - SolutionInn A 10-year $1,000 par value bond has a 9% semiannual. A 10-year $1,000 par value bond has a 9% semiannual coupon and a nominal yield to maturity of 8.8%. What is the price of the bond? Coupon. A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity.

www2.asx.com.au › bond-derivativesBond derivatives - Australian Securities Exchange Gain exposure to Australian debt markets by trading ASX Treasury Bond Futures and Options. Underpinned by a basket of liquid Australian Government Bonds, the 3, 5, 10 and 20 Year Treasury Bond Futures are a cost effective tool that can be used to enhance portfolio performance, manage duration, hedge risk exposures and take advantage of curve and spread trading opportunities.

› finance › bond-priceBond Price Calculator | Formula | Chart Jun 20, 2022 · coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

Question 12 a 10 year bond with a 9 annual coupon has Question 12 A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? Selected Answer: If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price.

› markets › rates-bondsUnited States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month

Post a Comment for "44 a 10 year bond with a 9 annual coupon"