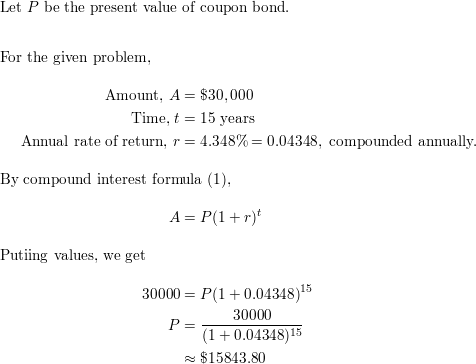

43 find the face value of the zero coupon bond

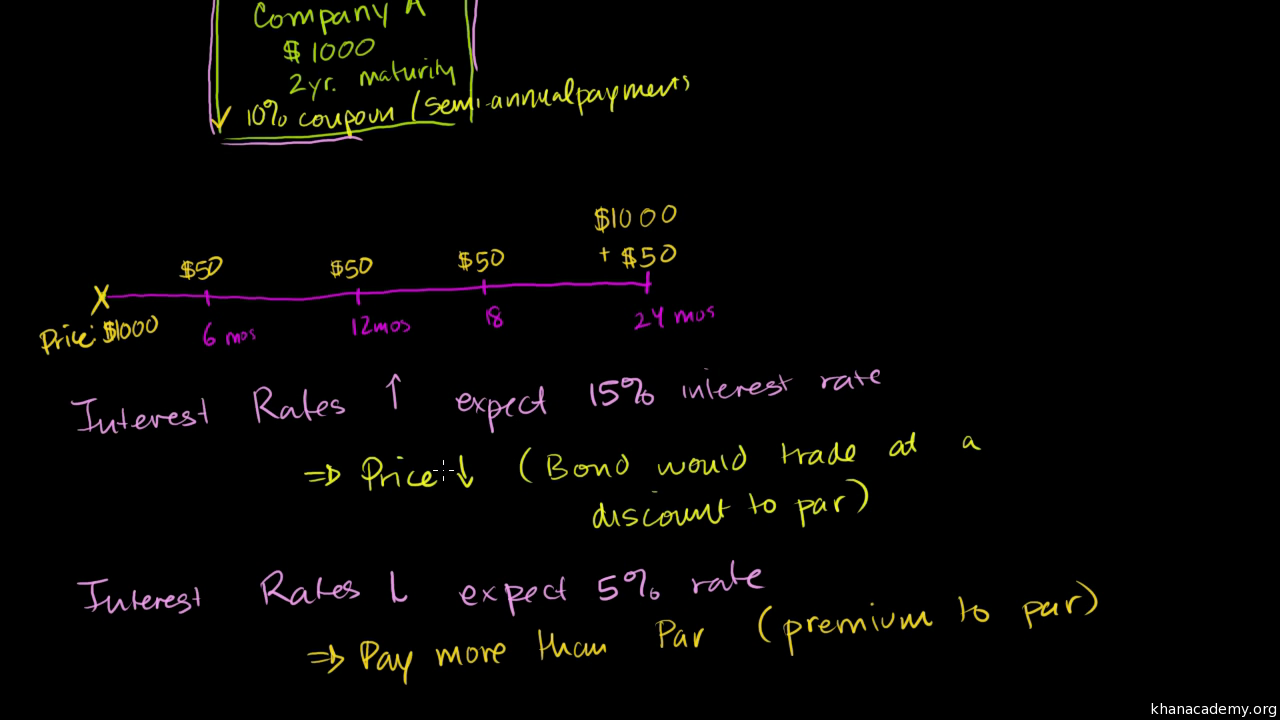

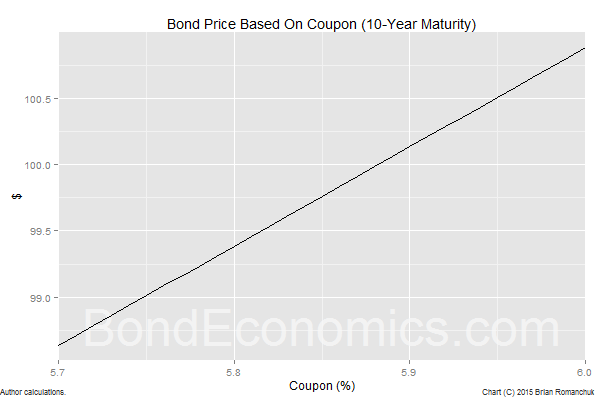

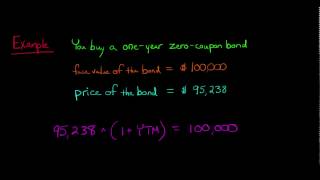

› Zero_Coupon_Bond_ValueZero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F , 6% would be r , and t would be 5 years. After solving the equation, the original price or value would be $74.73. › what-is-a-bond-couponWhat Is a Bond Coupon? - The Balance Mar 04, 2021 · Zero-Coupon Bonds . Zero-coupon bonds pay no cash interest. They're issued at a discount to their maturity value instead. The discount provides a cited rate of return by maturity when the bonds are supposed to be redeemed for their full face value.

› bootstrapping-yield-curveBootstrapping | How to Construct a Zero Coupon Yield Curve in ... The annual coupon payment is depicted by multiplying the bond's face value with the coupon rate. read more. Hence, the spot rate for the 6-month zero-coupon bond Zero-coupon Bond In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to its par ...

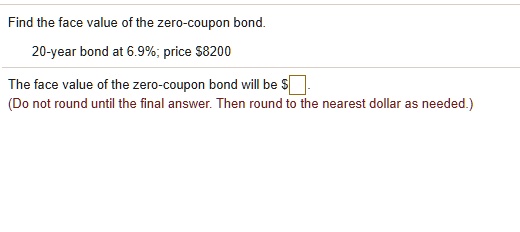

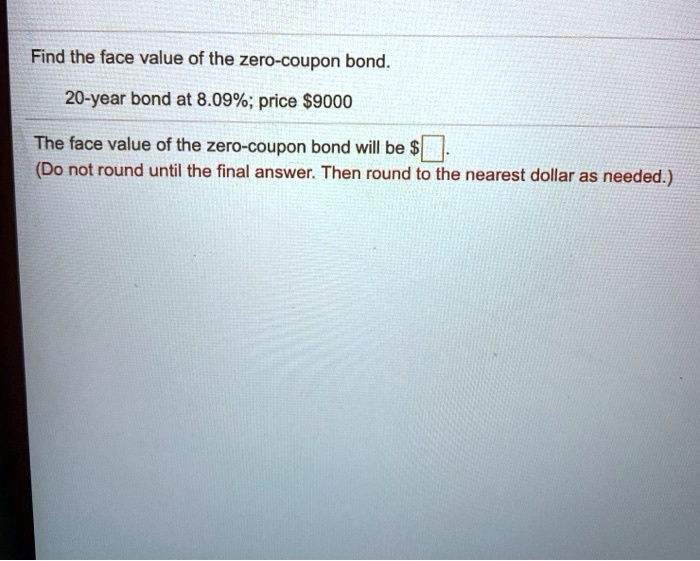

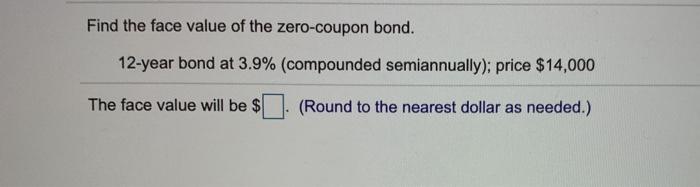

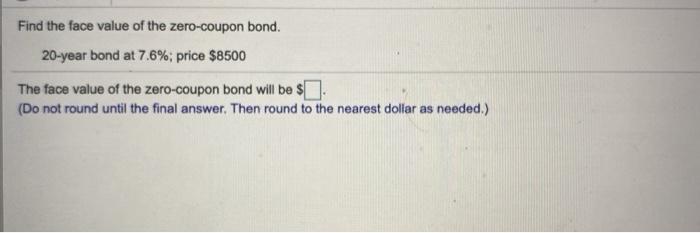

Find the face value of the zero coupon bond

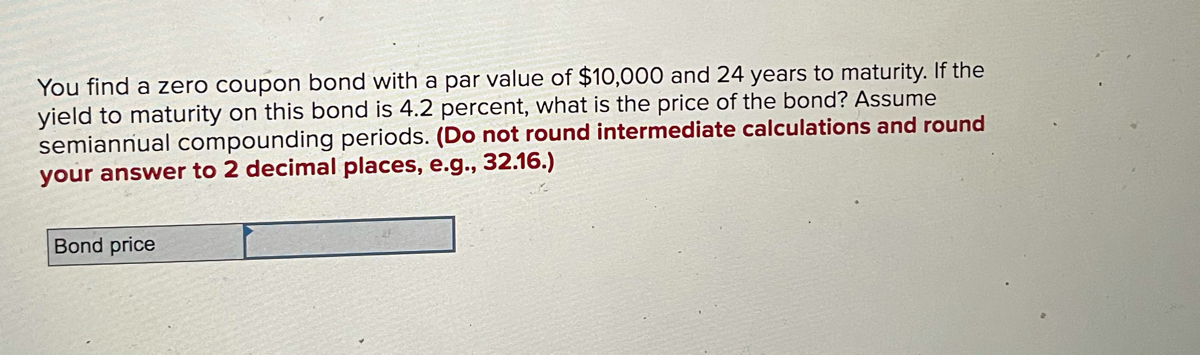

› terms › yYield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... › accounting › bondsCalculation of the Value of Bonds (With Formula) Find present value of the bond when par value or face value is Rs. 100, coupon rate is 15%, current market price is Rs. 90/-. The bond has a six year maturity value and has a premium of 10%. If the required rate of returns is 17% the value of the bond will be: = Rs 15(PVAF 17%6 Years)+110(PVDF 17% 6 years), = Rs. 15 x (3.589) +110 (.390) dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward:

Find the face value of the zero coupon bond. › bonds-payableHow to Calculate a Zero Coupon Bond Price | Double Entry ... Jul 16, 2019 · Using the example above, if the issue was a 10 year zero coupon bond, then the price at issue would be given as follows: n = 10 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 10 Zero coupon bond price = 508.35 (rounded to 508) dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward: › accounting › bondsCalculation of the Value of Bonds (With Formula) Find present value of the bond when par value or face value is Rs. 100, coupon rate is 15%, current market price is Rs. 90/-. The bond has a six year maturity value and has a premium of 10%. If the required rate of returns is 17% the value of the bond will be: = Rs 15(PVAF 17%6 Years)+110(PVDF 17% 6 years), = Rs. 15 x (3.589) +110 (.390) › terms › yYield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

:max_bytes(150000):strip_icc()/GettyImages-932585920-5c910a5846e0fb000172f0e8.jpg)

Post a Comment for "43 find the face value of the zero coupon bond"