41 zero coupon bonds tax

What are Zero-coupon Bonds? The yield on the zero-coupon bonds is also taxable at maturity in India. You can easily purchase zero-coupon bonds in the secondary markets in India. Zero-coupon bonds issued by the government of India are a safer bet even though they have a lower yield than corporate bonds. Zero-coupon bonds are suitable for risk-averse investors. Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are …

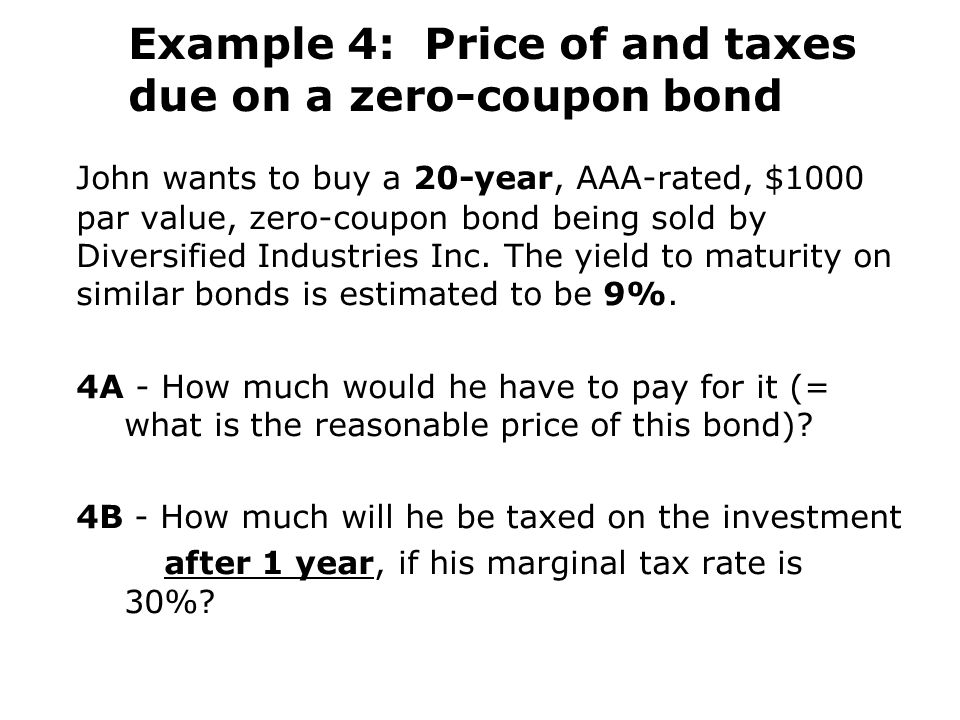

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

Zero coupon bonds tax

Municipal Bonds - Fidelity Zero-coupon bonds Zero-coupon municipal bonds are issued at an original issue discount, with the full value, including accrued interest, paid at maturity. Interest income may be reportable annually, even though no annual payments are made. Market prices of zero-coupon bonds tend to be more volatile than bonds that pay interest regularly. Zero Coupon Bonds- Taxability Under Income Tax Act, 1961 - TaxWink Unlike other bonds or debentures, investment in zero coupon bonds does not give any periodic return. Therefore, annual interest cannot be taxed on accrual basis in this case like other bonds or debentures. Under Income Tax Act, gains on sale of any securities shall be taxable as long term or short-term capital gains depending on the holding period. Tax Considerations for Zero Coupon Bonds - m.finweb.com With a zero coupon bond, you are not paid any interest over the life of the bond. At the end of the bond, you get the face value of the bond. The difference with this type of bond is that you can buy the bond at a serious discount to what its end value is. For example, you may only pay 70 to 80 percent of the value of the bond when you buy it.

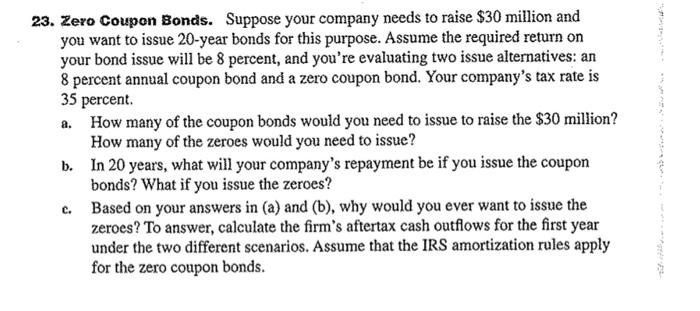

Zero coupon bonds tax. Zero-Coupon Bond: Definition, How It Works, and How To Calculate 31.5.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Do you pay taxes on zero coupon bonds? - Quora Answer: Yes. When zero coupon bonds first came out, you only paid tax when you sell them or at the end of their terms when you cash them in. This was one of the attractive aspects of zero coupon bonds for some people. For example, suppose you were currently aged 58 and earning enough money to be ... How to Buy Zero Coupon Bonds | Finance - Zacks The bonds are issued at a minimum face value of $1,000, and the earliest a Treasury zero bond matures is in 10 years. The bond interest income is taxed at the federal level and possibly at... Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Zero Coupon Municipal Bonds: Tax Treatment - TheStreet The question concerns tax-exempt zero-coupon municipal bonds. A regular bond pays interest on its face value, or principal, twice a year at a rate determined by its coupon. A bond... United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Coupon Price Yield 1 Month 1 Year Time (EST) GTII5:GOV . 5 Year . 1.63: 100.52: 1.52%-12 +323: 4:59 PM: The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. Impact of Taxation on Zero-Coupon Muni Returns - MunicipalBonds.com Tax risk: Although there are no interest payments made on zero-coupon bonds, investors may still be subject to the tax implications for the accrued interest part on the bond value for each year. This can be avoided by investing in zero-coupon munis. Do read due diligence on muni bonds to have a better understanding of the regulatory framework.

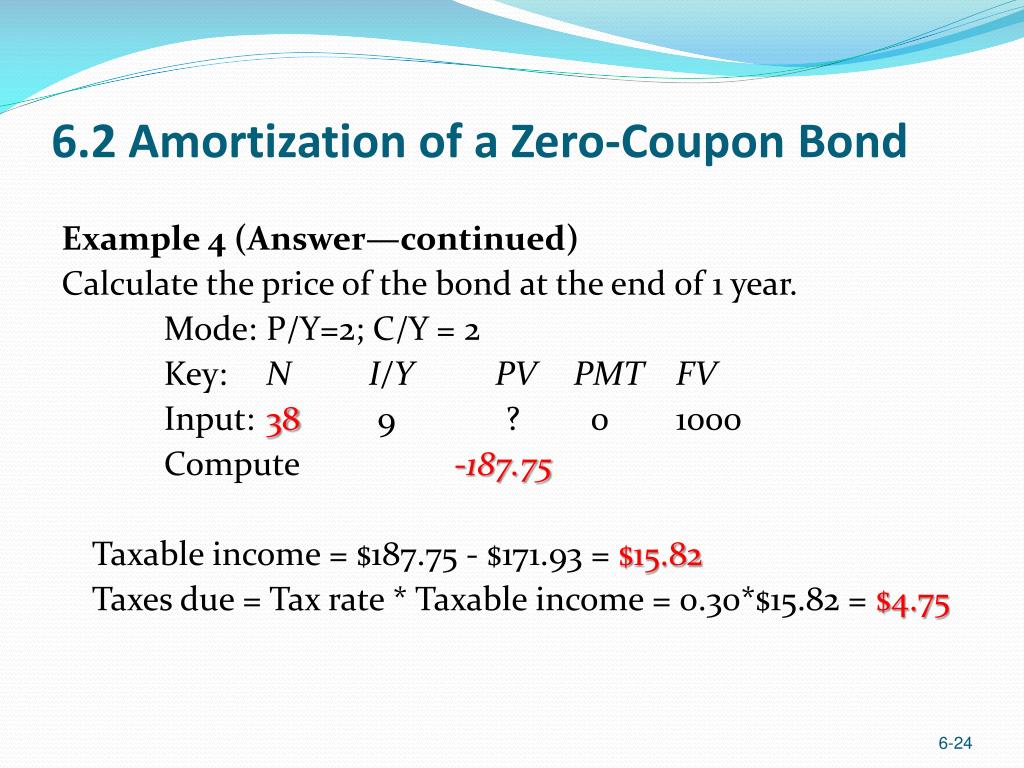

How is tax calculated on a zero coupon bond? - Quora The brokerage firm calculates it annually—and reports it on your annual tax statement—by multiplying the cost of the bond ($900) by the Yield to Maturity (5.4%). So, on a 2-year, zero-coupon bond you bought for $900, the imputed interest for this year would be $50. You will pay tax on the $50, whether you actually made $50 or not. The Basics of Bonds - Investopedia Jul 31, 2022 · Some municipal bonds offer tax-free coupon income for investors. Government (sovereign) bonds such as those issued by the U.S. Treasury. Bonds (T-bonds) issued by the Treasury with a year or less ... Zero-coupon bond - Wikipedia Therefore, zero coupon bonds subject to US taxation should generally be held in tax-deferred retirement accounts, to avoid taxes being paid on future income. Alternatively, when a zero coupon bond issued by a US state or local government entity is purchased, the imputed interest is free of U.S. federal taxes and, in most cases, state and local taxes. Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

Investor's Guide to Zero-Coupon Municipal Bonds Zero-coupon bonds are sold at a substantial discount from the face value. For example, a bond with a face value of $20,000, maturing in 20 years with a 5.5% coupon, may be purchased at issuance for roughly $6,757. At the end of the 20-year investment, the investor will receive the full $20,000 face value.

United States Treasury security - Wikipedia Treasury bills (T-bills) are zero-coupon bonds that mature in one year or less. They are bought at a discount of the par value and, instead of paying a coupon interest, are eventually redeemed at that par value to create a positive yield to maturity.. Regular T-bills are commonly issued with maturity dates of 4, 8, 13, 17, 26 and 52 weeks, each of these approximating a different …

Advantages and Risks of Zero Coupon Treasury Bonds If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will...

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is. Price = M / (1+r)n. where: M = maturity value or face value of the bond. r = rate of interest required. n = number of years to maturity. 3.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond is a discounted investment that can help you save for a specific future goal. Tara Mastroeni. Updated. Jul 28, 2022, 9:13 AM. Buying zero-coupon bonds can be a good deal for ...

How to Calculate Yield to Maturity of a Zero-Coupon Bond 10.10.2022 · Zero-coupon bonds often mature in ten years or more, so they can be long-term investments. The lack of current income provided by zero-coupon bonds discourages some investors.

Tax Considerations for Zero Coupon Bonds - Financial Web With a zero coupon bond, you are not paid any interest over the life of the bond. At the end of the bond, you get the face value of the bond. The difference with this type of bond is that you can buy the bond at a serious discount to what its end value is. For example, you may only pay 70 to 80 percent of the value of the bond when you buy it.

Zero-Coupon Bonds: Characteristics and Calculation Zero-coupon bonds are often perceived as long-term investments, although one of the most common examples is a “T-Bill,” a short-term investment. U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Learn More → Zero Coupon Bond (SEC) Zero-Coupon Bond Price Formula

Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the S&P 500 with dividends reinvested by 500% over the subsequent 30-years as interest rates fell from around 14.6% to around 3%. I started investing in 30 Year zero coupon treasuries. Now, zero coupon bonds don't pay any interest ...

How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond doesn't pay interest, but it could pay off for your portfolio. Choosing between the many different types of bonds may require a plan for your broader investments. A zero coupon bond often requires less money up front than other bonds. Yet zero coupon bonds still carry some of risk and can still be influenced by interest rates.

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1. Here are some general characteristics of zero coupon bonds: You must pay tax on interest annually even though you don't receive it until ...

Zero Coupon Bonds: Know tax rules when such a bond is held till ... Thus, taxation of zero coupon bond merely depends upon the period of holding. When a zero coupon bond is sold in the secondary market which was originally purchased from the primary...

How are Bonds Taxed Under the Income Tax Act? - Wint Wealth 1. Zero-Coupon Bonds. Zero-coupon bondholders are liable to only capital gain tax as they do not provide any interest income. However, these are issued at a discount. Hence, the difference is taxed as capital gain. 2. Market-Linked Bonds. Market-linked bonds offer fixed interest, and the interest rates are linked to the index it is tracking ...

How Do I Buy Zero Coupon Bonds? | Budgeting Money - The Nest Step 2. Buy the bonds through a tax-deferred retirement account to defer the income taxes on the interest income. Although you do not receive the interest on zero coupon bonds directly each year, you can still be taxed on the "phantom" interest that accrues each year. If you purchase the bonds through a retirement account, you'll only pay ...

Section 2(48) Income Tax: Zero Coupon Bonds - CA Club a) Meaning of 'Zero Coupon Bond': Section 2 (48) Income Tax As per Section 2 (48) of Income Tax Act, 1961, unless the context otherwise requires, the term "zero coupon bond" means a bond- (a) issued by any infrastructure capital company or infrastructure capital fund or public sector company or scheduled bank on or after the 1st day of June, 2005;

Zero-Coupon Bonds - Tax Professionals Member Article By Carmen Garcia The downside of zero-coupon bonds is that they may not offer the investor as many benefits, such as a higher return on investment and tax benefits. These types of bonds also have a higher risk because there is no income over their useful life.

The ABCs of Zero Coupon Bonds | Tax & Wealth Management, LLP Zero coupon bonds are subject to an unusual taxation in which the receipt of interest is imputed each year, requiring holders to pay income taxes on what is called "phantom income." Target Dates For individuals, zero coupon bonds may serve several investment purposes.

How to Invest in Zero-Coupon Bonds - US News & World Report The problem can be avoided with a tax-free municipal zero-coupon bond, or by holding the zero in a tax-preferred account like an individual retirement account. Volatility is a second issue.

Tax Considerations for Zero Coupon Bonds - m.finweb.com With a zero coupon bond, you are not paid any interest over the life of the bond. At the end of the bond, you get the face value of the bond. The difference with this type of bond is that you can buy the bond at a serious discount to what its end value is. For example, you may only pay 70 to 80 percent of the value of the bond when you buy it.

Zero Coupon Bonds- Taxability Under Income Tax Act, 1961 - TaxWink Unlike other bonds or debentures, investment in zero coupon bonds does not give any periodic return. Therefore, annual interest cannot be taxed on accrual basis in this case like other bonds or debentures. Under Income Tax Act, gains on sale of any securities shall be taxable as long term or short-term capital gains depending on the holding period.

Municipal Bonds - Fidelity Zero-coupon bonds Zero-coupon municipal bonds are issued at an original issue discount, with the full value, including accrued interest, paid at maturity. Interest income may be reportable annually, even though no annual payments are made. Market prices of zero-coupon bonds tend to be more volatile than bonds that pay interest regularly.

Post a Comment for "41 zero coupon bonds tax"